Now is a good time to ask whether withholding access to accrued wages until mid-month is the best approach to paying employees. A better alternative is available: providing employees instant access to earned wages through digital pay advances.

Employees, particularly in the current economic environment, struggle to meet unexpected costs. Whether the result of home or car repair, health, or the fallout from a global pandemic, unplanned expenditures can cause anxiety, and worse, recourse to "solutions" like payday loans or expensive credit cards. Financial stress impacts not only individuals, but their employers, who suffer a loss of productivity and worker retention when employees are finding it hard to make ends meet.

Just as COVID-19 has led some employers to question the necessity of having employees come to the office every day, the current economic crisis should lead to a broadscale re-examination of the standard pay cycle. The gig economy and some companies with hourly employees and independent contractors are currently offering instant pay advances, but they make up a small percentage of employers. Only six percent of today’s workforce is currently being paid on-demand.

What does financial wellness mean for employees and how can benefit managers and program partners help?

Benefit managers, payroll service providers, workforce management companies and professional employer organizations have a real opportunity to assess the financial challenges faced by employees and initiate on-demand pay and employee wellness programs for the benefit of both employees and their employers.

In a recent 2019 survey on employee financial wellness by PwC, respondents defined the term as being stress-free and achieving financial stability. Financial wellness of this sort is currently elusive for most employees. An estimated seventy-eight percent of people working today live with the stress of having to wait until payday just to get by. This includes one in three households earning between $50,000 and $100,000 a year, along with one in four households making $150,000 or more a year.

As many as 12 million Americans are estimated to use payday loans every year, whose high rates of interest only perpetuate financial stress.

This is where instant advances of accrued wages can make a substantial impact on the financial well-being of workers: by offering a low-cost, non-credit alternative to payday loans. With the right solution provider, earned wage access can be the cornerstone of long-term financial wellness.

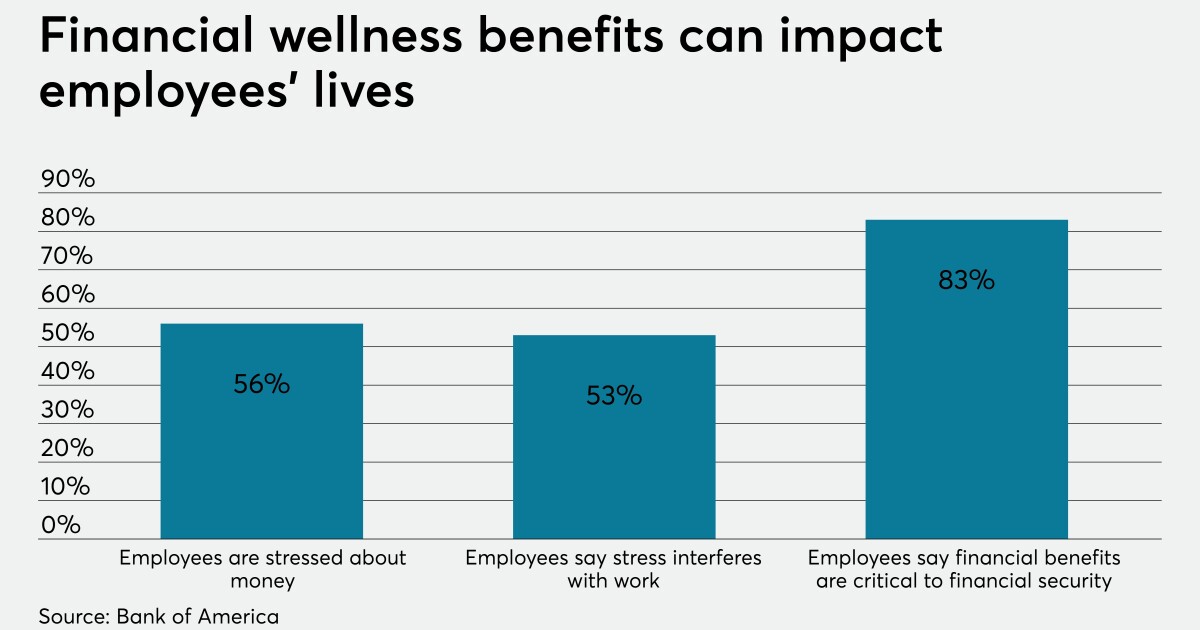

Talent recruitment and employee retention are additional reasons for employers to consider offering earned wage access. A number of recent surveys make it clear that today's workers want an employer who can help them make ends meet:

Benefit managers considering an on-demand pay program to supplement their payroll process should consider the following:

How can employees’ short- and long-term financial goals be addressed?

In the short-term, workers should have the flexibility to get immediate access to the money they have earned at little to no additional cost.

Employees’ long-term financial goals should be addressed with budgeting and savings tools to help achieve a greater sense of financial stability. Depending on the program partner, this may include bill pay options and value-added offerings like employer discounts and rebates.

How easy is it for the employer and employee to use?

Implementation should be straightforward and minimize disruption to payroll processes. Program parameters should be easy to set. This includes streamlined reporting functions and the ability to easily establish wage-disbursement guidelines and other risk controls.

What key functions should be included?

Flexibility in program implementation is critical. An on-demand pay program should not only be easy to deploy, but it should also be easy to maintain. Simple activations, mobile-friendly communication and alert functions, and a user-friendly dashboard are all important features to consider. Minimizing fees and charges for employees also support program adoption.

The future of payday

Addressing pay-cycle struggles shows employees they are valued. It addresses wide-spread economic stresses. It is a modern benefit that supports financial wellness for the employee and the employer at a materially lower cost to the employer and the employee than existing alternatives such as payday loans or credit card balances.

Today's cloud-based and API-driven technology platforms can enable on-demand pay at low cost and with minimal integration challenges. With a strong business rationale supporting it, few barriers to its implementation, and an economic climate demanding attention to financial wellness, access to instant advances of accrued pay is likely to become an increasingly prevalent employee benefit.

"pay" - Google News

August 19, 2020 at 09:30PM

https://ift.tt/3hdPlOL

Why it's time to re-examine the standard pay cycle - Employee Benefit Adviser

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "Why it's time to re-examine the standard pay cycle - Employee Benefit Adviser"

Post a Comment