President Joe Biden has proposed raising taxes on corporations and wealthy Americans to help pay for a series of new initiatives, ensuring that the issue of taxes will be front and center for Congress in the weeks and months ahead.

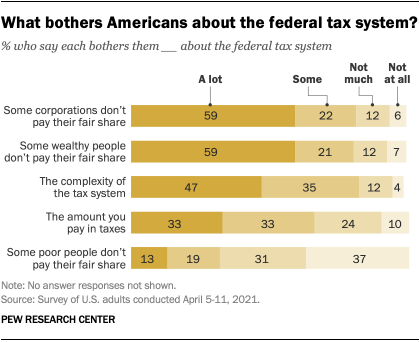

The public’s frustrations with the U.S. tax system have not changed much in recent years. Far more Americans continue to say they are bothered “a lot” by the feeling that some corporations and wealthy people do not pay their fair share of taxes than by the complexity of the tax system or even the amount they pay in taxes.

Majorities of Americans say they are bothered a lot by the feeling that some corporations and wealthy people don’t pay their fair share in taxes (59% each), according to a Pew Research Center survey conducted April 5-11.

Pew Research Center conducted this study to understand Americans’ views of the U.S. federal tax system. For this analysis, we surveyed 5,109 U.S. adults in April 2021. Everyone who took part is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology.

Here are the questions used for the report, along with responses, and its methodology.

Nearly half (47%) say they are bothered a lot by the complexity of the federal tax system, while a third say the same about the amount they pay in taxes. Just 13% express a similar degree of frustration with the feeling that some poor people don’t pay their fair share in taxes. For four of the five items asked about in the survey – the exception being the sense that the poor do not pay their fair share in taxes – sizable majorities say they are bothered a lot or some. Relatively few say they are bothered not much or not at all by these aspects of the tax system.

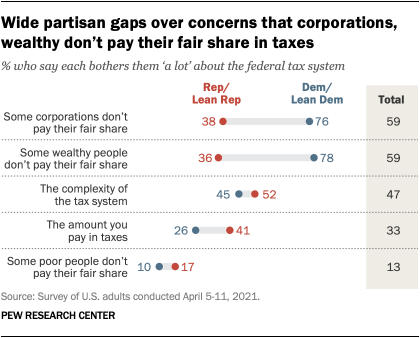

Democrats and Democratic-leaning independents are far more likely than Republicans and GOP leaners to say they are bothered “a lot” by the feeling that some corporations don’t pay their fair share in taxes (76% vs. 38%). There is a similar gap over the feeling that some wealthy people don’t pay their fair share (78% of Democrats vs. 36% of Republicans).

Partisan differences are smaller for the other items in the survey.

About half of Republicans (52%) and 45% of Democrats say they are bothered a lot by the tax system’s complexity. And while 41% of Republicans say they are bothered a lot by the amount they pay in taxes, a smaller share of Democrats (26%) say the same.

Just 17% of Republicans and 10% of Democrats say they are bothered a lot by the feeling that some poor people don’t pay their fair share. This is the lowest-ranked concern in both party coalitions.

Views of personal tax burden differ by age, party

For the second time in two years, the IRS has delayed Tax Day this year because of the coronavirus outbreak. Individual tax returns will be due May 17 instead of the customary date of April 15.

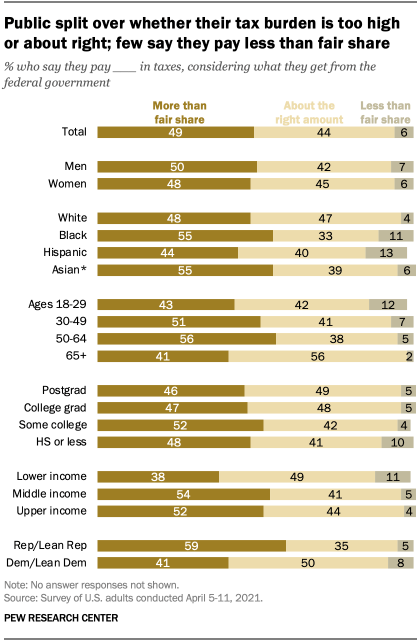

In the Center’s latest survey, around half of Americans (49%) say they pay more than their fair share in taxes, considering what they get from the federal government, while 44% say they pay about the right amount in taxes. Few (6%) say they pay less than their fair share in taxes.

There are modest demographic differences in Americans’ views of their personal tax burden, with a few exceptions.

Americans 65 and older are the only age group in which a majority (56%) say they pay about the right amount in taxes. Those ages 30 to 64 are more critical, with a little over half (53%) saying they pay more than their fair share in taxes.

Views among those ages 18 to 29 are mixed: 43% say they pay more than their fair share in taxes, and 42% say they pay the right amount. Similar shares of upper- and middle-income Americans (52% and 54%, respectively) say they pay more than their fair share in taxes, but fewer lower-income adults (38%) say the same.

Republicans are more critical of their own tax burden than Democrats. A majority of Republicans and Republican-leaning independents (59%) say they pay more than their fair share in taxes, while 35% say they pay about the right amount. Among Democrats and Democratic leaners, a larger share say they pay about the right amount (50%) than say they pay more than their fair share (41%).

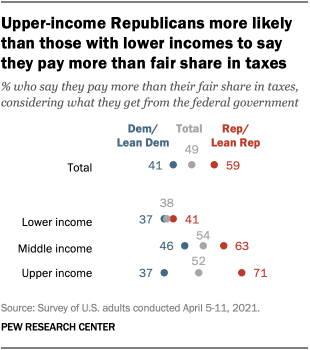

Views of personal tax burdens also differ by income tier within each partisan group.

Upper-income Republicans (71%) are far more likely than middle-income (63%) and lower-income Republicans (41%) to say they pay more than their fair share in taxes, considering what they get from the federal government.

The pattern among Democrats is different. Nearly half of middle-income Democrats (46%) say they pay more than their fair share in taxes, but this view is less common among both upper- and lower-income Democrats (37% in each group).

As a result of these differences, partisan gaps are wider among higher-income groups than among lower-income tiers. For example, 71% of upper-income Republicans say they pay more than their fair share in taxes, versus 37% of upper-income Democrats. There is little partisan difference among lower-income Americans.

Note: Here are the questions used for the report, along with responses, and its methodology.

"pay" - Google News

April 30, 2021 at 10:02PM

https://ift.tt/3xDAp4P

Top tax frustrations for Americans: The feeling that some corporations, wealthy people don't pay fair share - Pew Research Center

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "Top tax frustrations for Americans: The feeling that some corporations, wealthy people don't pay fair share - Pew Research Center"

Post a Comment