Gov. Mike Dunleavy’s push to enshrine the PFD in the constitution has run into stiff opposition with legislators across the political spectrum and, to hear it from the legislators themselves, even the governor’s state-sponsored campaign isn’t doing much to excite Alaskans.

The biggest problem—well, other than the ever-shifting promises the governor has made and has failed to deliver on with the dividend—is that Dunleavy and company would very much like legislators to not look too closely at the details of the rest of the plan. $200 million in additional cuts? No problem! $300 million in additional cuts and/or taxes? You betcha! Anemic capital budgets forever? It’s fine, probably! Oil revenues and the investment market go up forever? Bank on it!

If it were only that simple.

As it stands, legislators are broadly unwilling to enshrine the dividend in the constitution when the “What comes next?” could be anything from deep cuts to K-12 funding and Medicaid to a slate of unknown taxes. While the Dunleavy administration has met legislators’ continued pleas for details and leadership with a shrug, the House Judiciary Committee (which is really putting in the bulk of the work this special session) heard two alternative proposals on Wednesday that importantly answer the question of “what’s next.”

The proposals were pitched by Anchorage Republican Sen. Natasha von Imhof and Fairbanks Democratic Rep. Adam Wool. Both proposals are based off a more realistic set of assumptions about future revenue and lack of political will to make the deep additional cuts Dunleavy himself hasn’t been able to make. Importantly, both also balance the budget without leaving several glaring question marks to be resolved by future legislators. They do, however, approach the question of the dividend from very different goals in mind.

Sen. von Imhof’s described her plan a math exercise trying to figure out how to pay a dividend while keeping Alaska free of a broad-based tax such as an income tax or sales tax.

“Do we institute personal taxes on every citizen in order to pay a dividend? Why would we tax the wages of one person only to deposit their money into the personal checking account of their neighbor? It doesn’t make sense to me,” she said, later explaining the plan as follows, “I approached this as an economic exercise and a mathematical exercise. I’m trying to find the largest dividend we can afford without instituting taxes.”

Sen. von Imhof’s plan, which is contained in SJR 18, is a constitutional amendment that would set up the Alaska Resource Ownership Revenue Account (ARORA) separate from the Alaska Permanent Fund that would be directly responsible for paying PFDs. It would be seeded with about $6.7 billion from the Alaska Permanent Fund, roughly equivalent to the amount of “unpaid” dividends, and would get about 12.5% of future oil and gas royalty revenue. It’s a plan that wouldn’t require taxes and, like other attempts at closing the budget deficit without taxes, would start dividends out at about $500 with growth largely depending on the success of the oil industry.

What about cuts to the PFD? Aren’t those taxes? “It’s not a tax,” she argued. “It’s less free money, that’s all it is.”

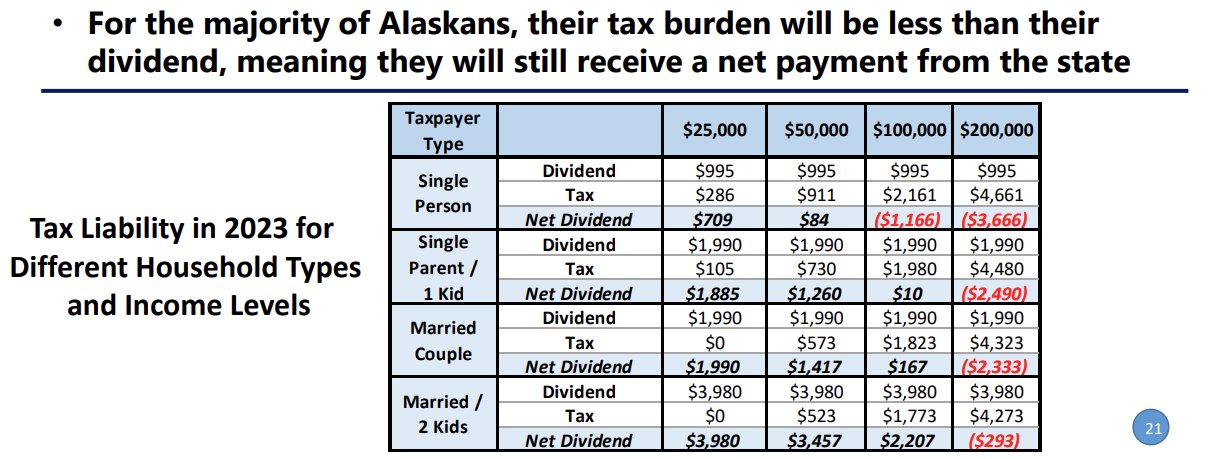

Rep. Wool argued that he sees value in paying a larger dividend in large part because it would make the state’s approach to balancing the budget more equitable, while diversifying the state’s revenue would have the benefit of better linking the health of the state budget to the health of the economy. His plan would implement an income tax of 2.5% on federal gross adjusted income and pay out dividends using 10% of the spendable earnings of the Alaska Permanent Fund and 30% of oil and gas royalties. It would pay a dividend of roughly $1,000 with growth reliant on oil and investment revenue. The combination of the income tax and the dividend payment, he argued, would create a sort of needs testing for the dividend.

“The 2.5% tax is fairly low and the PFD itself could be applied to pay the tax. Most Alaskans would get a net positive check or a net neutral financial experience. They can click on the box and the PFD can go to their tax and for many people, they will still have some PFD left over,” he said. “This creates a built-in means testing for the PFD program. … Some upper income people say, ‘Oh, let’s just get rid of the PFD. I don’t really need it.’ Sure, if you’re making $100,000, you probably don’t necessarily need a PFD, but people who are making $5-, $10-, $20,000 they really do need that PFD,”

Most Alaskans, he argued, would receive more under this model than would pay to government. The first $25,000 of income would be exempted from taxes. A married couple with two kids, for example, would only start to pay taxes once their household income nears the $200,000 a year mark. Most families earning $50,000 or less would keep a large chunk of the dividends.

Wool noted that the tax “doesn’t necessarily pay the PFD, but it replaces the hole left in the general fund by paying a PFD.”

Far-right Wasilla Republican Rep. Christopher Kurka commented later in the hearing: “Isn’t this straight up communism?”

Ken Alper, an aide to Wool who’s been closely involved in efforts to balance the budget, replied that people collectively paying for government has been going on for a long time: “That’s just a normal thing people do.”

Neither plan are officially in front of the Legislature during this special session, which has its agenda limited by Gov. Dunleavy. Legislators are slated to consider revenues during a fall special session though Dunleavy and his administration have been noncommittal about introducing or backing any new revenue proposals.

"pay" - Google News

June 11, 2021 at 03:04AM

https://ift.tt/2RKyLhQ

'Pick. Click. Pay your taxes.' Legislators hear alternative PFD proposals - The Midnight Sun

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "'Pick. Click. Pay your taxes.' Legislators hear alternative PFD proposals - The Midnight Sun"

Post a Comment