Google Pay is apparently just as much a disaster internally as the app transition has been externally. That's the big takeaway from a recent Business Insider article detailing an exodus of executives from Google's payment division, lower-than-expected app adoption, and employees frustrated with the slow movement of the division.

Business Insider spoke with ex-employees and learned that "dozens of employees and executives have left" the Google Payments team in recent months, including "at least seven leaders on the team with roles of director or vice president." The most prominent departure, of payments chief Caesar Sengupta, kicked off the exodus in April, and now employees are worried about another reorganization and even slower progress. Many rank-and-file team members have reportedly departed, too, with the story saying, "One former employee estimated that half the people working on the business-development team for Google Pay—a group of about 40 people—have left the company in recent months."

In 2018, Sengupta took over the payments division, which oversees the Google Pay app and the wider Google payments infrastructure, and the report says that "much of Sengupta's attention was on bringing the US Google Pay app more in line with the version Google built for India."

That's a reference to Google Pay's big March revamp, which killed the existing app and website and essentially replaced it with an entirely new service. We weren't big fans of the update, which featured a lot of reduced functionality and a clumsy transition plan for existing users. It seems like we weren't alone in our disappointment; the report quotes a former payments employee as saying, "Caesar [Sengupta] leaving was the capstone on a lot of frustration felt by employees. The product wasn't growing at the rate we wanted it to." Sengupta departed Google one month after killing the old Google Pay and making his new app mandatory for all users in the US.

The “New Google Pay” disaster

The new Google Pay app launched in November 2020 in the US, and for about four months, Google was running two "Google Pay" apps: the old Google Pay (which had been around since 2011, first as Google Wallet, then Android Pay, then Google Pay) and this new Google Pay, which was a ground-up rewrite the company started for the Indian market. April 2021 capped off the final death of the old Google Pay service, which had been winding down since January. The two services were both called "Google Pay," but other than that, they weren't related in terms of features, contacts, or accounts.

We reviewed the new Google Pay right around this time and found it to be a pretty poor service compared to what Google had previously. The new service used SMS instead of a Google account for your identity, meaning that it didn't support multiple devices, didn't support multiple accounts, and no longer supported website use. Your phone was the only way to access a functional Google Pay, and everything was tied to your carrier's phone number.

NFC payments on Android mostly worked the same, but P2P users had to go through a clumsy transition. Users on the new app couldn't send money to users on the old app, so as your contact list slowly switched over, Google Pay just became an unusable mess for the next few months. "I sent you money on Google Pay" was no longer enough; users would have to suss out for themselves whether "Google Pay" meant the new app or the old app. Google should have worked to make the transition easy, but it didn't, and the result was months of what was essentially downtime for the service. Sending money through "Google Pay" was no longer reliable for anyone but the savviest users, thanks to version incompatibilities.

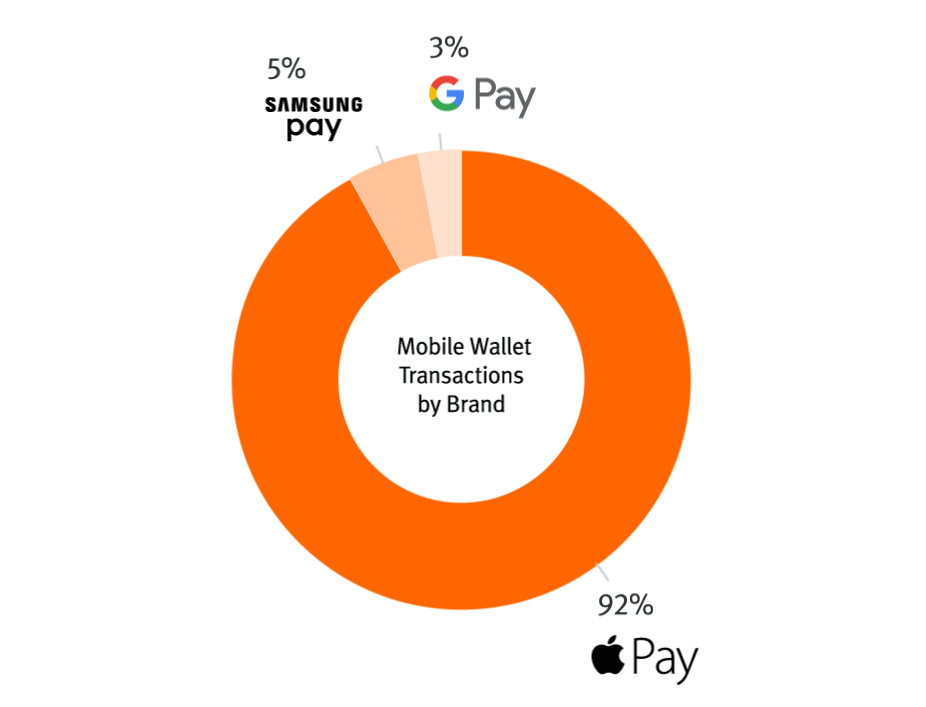

Google's upending of Google Pay isn't completely unmotivated. A survey last year by Pulse, a Discover company, said that Google Pay had a measly 3 percent market share, while Apple Pay—which joined the NFC payment market years after Google—had a 92 percent share of mobile payments. Something probably needed to change for Google Pay, but these are stats for NFC payments, and New Google Pay changed basically nothing about NFC payments.

Next up: Google bank accounts?!

Next up for the New Google Pay app is the launch sometime the year of a "Plex" banking service, which will be a full-blown Google bank account, thanks to a partnership with Citibank. One of the employees Business Insider spoke to said, "Plex was entirely [Vice President] Felix [Lin] and Caesar [Sengupta's] brainchild," and now both of those executives no longer work at Google. Progress on the bank account has already been "slower than expected," according to the report, and without its two leading architects, Plex may be delayed.

There's one question I'm not sure anyone on the payments team has asked, and it might be worth looking into: Does anyone out there actually want a Google bank account?

"pay" - Google News

August 24, 2021 at 12:30AM

https://ift.tt/3zdLE4r

Google Pay team reportedly in major upheaval after botched app revamp - Ars Technica

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "Google Pay team reportedly in major upheaval after botched app revamp - Ars Technica"

Post a Comment