CNN Underscored reviews financial products such as credit cards and bank accounts based on their overall value. We may receive a commission through The Points Guy affiliate network if you apply and are approved for a card, but our reporting is always independent and objective.

In an effort to keep its card portfolio fresh in the midst of a long travel slowdown, Chase continues to roll out new travel point redemption options on its credit cards. On Monday, the issuer expanded its recently introduced “Pay Yourself Back” tool to include several additional card families, and extended the existing eligible categories on its two primary Sapphire cards.

First launched in May, the “Pay Yourself Back” tool currently allows Chase Sapphire Reserve and Chase Sapphire Preferred Card holders to redeem their Ultimate Rewards points for purchases made at grocery stores, dining establishments (including delivery and takeout) and home improvement stores. These initial categories, which were originally scheduled to remain through September 30, have been extended through April 30, 2021, and also now include contributions to a dozen eligible charities.

In addition, through the end of next April, Sapphire Reserve card holders will continue to get 1.5 cents per point when redeeming via the “Pay Yourself Back” tool, with Sapphire Preferred card holders getting 1.25 cents per point. This is the same value that these card holders get when redeeming points for travel via Chase’s travel portal.

Related: Chase Sapphire Preferred vs. Chase Sapphire Reserve: Which is best for you?

The list of eligible charities that can be used with the “Pay Yourself Back” tool currently includes:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- Habitat for Humanity

- International Medical Corporation

- Leadership Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Thurgood Marshall College Fund

- United Negro College Fund

- United Way

- World Central Kitchen

Chase Sapphire Reserve card holders can also continue to use the card’s $300 travel credit on gas and grocery store purchases through Dec. 31, along with the usual eligible travel charges. The credit automatically applies to any eligible purchase made in the additional categories through the end of 2020.

Previously, Chase extended its annual fee reduction for existing Sapphire Reserve card holders with renewal dates through Dec. 31, 2020. Until the end of the year, the issuer is only charging $450 to renew for an additional 12 months, which is a $100 discount on the card’s normal $550 annual fee.

“Pay Yourself Back” tool added to more Chase cards

Starting October 1, Chase’s Ink Business Preferred Credit Card, along with its Ink Business Plus card (which is no longer open to new applicants) will also have access to the “Pay Yourself Back” tool. However, the eligible categories for these cards will be more business-focused. At launch, they include select online advertising and shipping expenses, as well as contributions to the same eligible charities as the two Sapphire cards.

When redeeming points from either of the two Ink cards using the “Pay Yourself Back” tool, each point will be worth 1.25 cents per point, again matching the value of these points when redeemed for travel via the Chase travel portal. The initial categories will remain available through Dec. 31, 2020.

Chase is also adding a limited-time bonus category to its Ink Business Preferred and Ink Business Plus cards. Through October 31, card holders can earn 5 points for every dollar spent on shipping, and on select advertising purchases made on social media and search engines, up to $10,000 spent in combined purchases across the categories.

Related: Chase launches highest-ever 100,000-point bonus on the Ink Business Preferred.

Additionally, as of October 1, the family of Chase Freedom credit cards will be able to utilize the “Pay Yourself Back” tool to make donations to the same list of charities as the Sapphire and Ink cards. This includes the new Chase Freedom Flex and the Chase Freedom Unlimited, as well as the old Chase Freedom card (which is no longer open to new applicants).

The three Chase Freedom credit cards nominally earn cash back rewards rather than travel points. However, the cash back on these cards is initially issued in the form of points, which can then be redeemed for cash back at a rate of 1 cent per point. However, when using the “Pay Yourself Back” tool with the Freedom cards to donate to an eligible charity, the points will be worth 1.25 cents apiece.

Related: New Chase Freedom Flex credit card now available with $200 sign-up bonus.

How to use the “Pay Yourself Back” tool

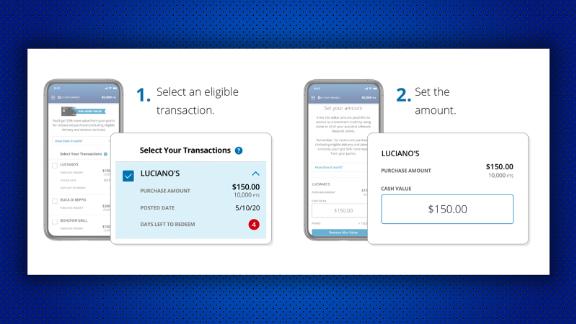

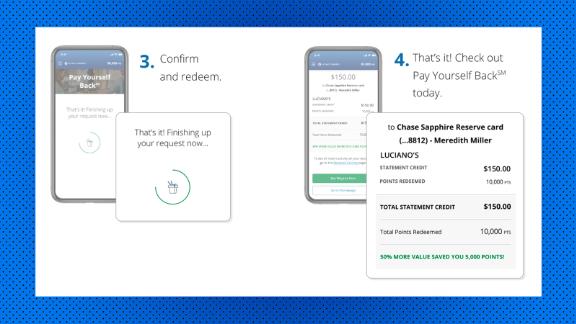

If you have any of the eligible Chase credit cards, once you’ve made an eligible purchase, you can log into your Ultimate Rewards account, either via desktop or Chase’s mobile app, to find the “Pay Yourself Back” tool.

From there, use the tool to find any eligible transactions made on your card in the previous 90 days, and then choose to apply your points for either a portion of the purchase or the entire amount. The points will be deducted from your account and you’ll see a statement credit for the corresponding amount within three business days.

CNN Underscored’s partner The Points Guy values Chase Ultimate Rewards points at 2 cents apiece, thanks to the program’s ability to transfer points with either of the Sapphire or Ink cards at a 1-to-1 ratio to 13 airline and hotel loyalty programs. Strategically transferring points this way makes it possible to score premium redemptions, such as first and business class airline tickets, at a fraction of what it would normally cost.

However, using transferred points is complicated and can require a great deal of time and research. As a result, many Chase card holders prefer to redeem their points through the Chase travel portal. If you’re one of these people, you’re getting the same value with the “Pay Yourself Back” tool as you normally would when redeeming for travel with an eligible Sapphire or Ink card, so it can make sense to take advantage of them.

A welcome if imperfect expansion

The initial categories included with the “Pay Yourself Back” tool for the Chase Sapphire Preferred and Chase Sapphire Reserve cards have been popular, so it’s extremely welcome to see them extended for a significant period. The new eligible Ink categories may also be useful to small business owners looking to tighten up their cash flow during the economic downturn.

However, it’s slightly disappointing to see only charity donations added as an eligible category to the Chase Freedom card family. While the no-annual-fee Freedom cards generally get fewer premium benefits than their annual-fee counterparts, it would have been useful for Chase to offer an option that Freedom card holders could use toward their personal expenses along with being philanthropic.

Regardless, it’s certainly a plus to see Chase continue to expand the “at home” benefits of its credit cards, much as its competitors have done. So if you have an eligible Chase credit card and would rather use your points now instead of letting them sit, you may want to take a look at these expanded redemption options.

Learn more about the Chase Sapphire Preferred.

Learn more about the Chase Sapphire Reserve.

Learn more about the Ink Business Preferred Credit Card.

Learn more about the Chase Freedom Flex.

Learn more about the Chase Freedom Unlimited.

Get all the latest personal finance deals, news and advice at CNN Underscored Money.

"pay" - Google News

September 28, 2020 at 07:38PM

https://ift.tt/30bolZt

Chase expands "Pay Yourself Back" point redemptions to include additional credit cards - CNN

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "Chase expands "Pay Yourself Back" point redemptions to include additional credit cards - CNN"

Post a Comment