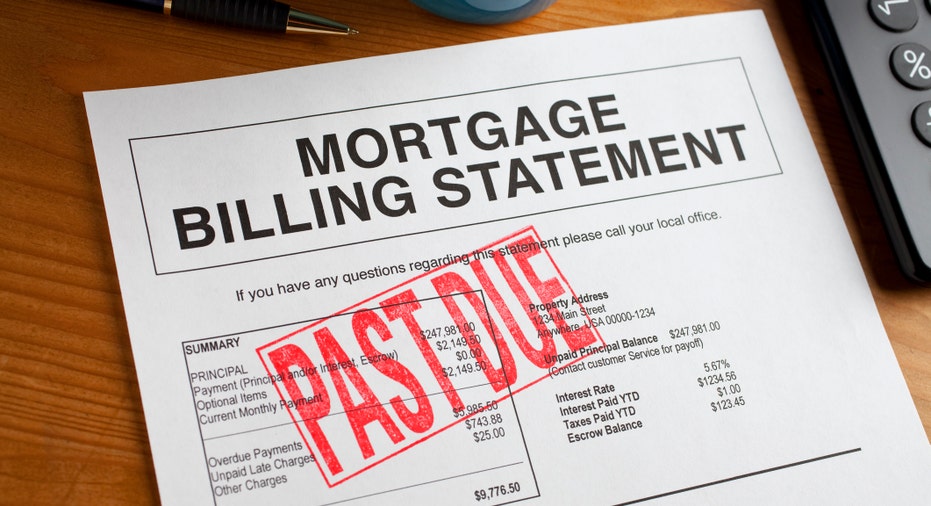

If you’re struggling to pay your mortgage during the pandemic, there is assistance available. Here’s a look at your options. (iStock)

Several months into the COVID-19 pandemic, hardships like unemployment are still impacting homeowners and making it hard for them to keep up with mortgage payments.

Continue Reading Below

In fact, according to recent data from The Mortgage Bankers Association, an estimated 2.8 million homeowners are currently utilizing a forbearance plan on their loan. Luckily, the government is offering some assistance to those in need and solutions such as completing a mortgage refinance can help.

If you think that mortgage refinancing might be the right option for you, visit Credible to compare rates and lenders. Otherwise, read on below to get a sense of what other options are available to you.

Mortgage relief options

If you're having trouble keeping up with your monthly mortgage payments, don't fear. There are some mortgage relief options you can consider. Here are three things you can try right now to help ease the financial burden of mortgage payments.

- Consider a mortgage refinance to reduce monthly payments

- Request forbearance

- Contact your mortgage lender

1. Consider a mortgage refinance to reduce monthly payments

If your loan is still in good standing, it may make sense to refinance in order to save on mortgage payments. Completing a mortgage refi involves taking out a new loan with better terms in order to make your payments more manageable. Right now, we are experiencing record low interest rates, which means that the vast majority of borrowers should be able to save money each month, whether they are after rock-bottom mortgage refi rates or first-time homebuyers.

According to Freddie Mac, interest rates for 30-year fixed-rate loans are currently averaging 2.71%, which translates to a monthly payment of $1,218 on a $300,000 home. For comparison, the same mortgage at an interest rate of 3.71% would have a monthly payment of $1,383.

You can take a look at your mortgage refinance options by using Credible to compare rates and lenders.

MILLIONS OF HOMEOWNERS CAN LOWER MORTGAGE PAYMENTS BY DOING THIS RIGHT NOW

2. Request mortgage forbearance

On the other hand, if you are having trouble keeping up with your current mortgage payments, another option may be to seek forbearance. With mortgage forbearance, your lender agrees to let you temporarily suspend or reduce your mortgage payments for a set period of time. However, forbearance is not the same as loan forgiveness because you're required to eventually make up the payments.

The Department of Housing and Urban Development (HUD) recently announced an extension that allows single-family homeowners with FHA-insured mortgages to request forbearance until Dec. 31, 2020. Under the extension, lenders must provide forbearance for at least six months, plus an additional six months if it is requested by the homeowner. Notably, many private mortgage refinance servicers and banks are also offering forbearance options during the coronavirus pandemic.

For mortgage borrowers who think that forbearance might be the right choice, contact your lenders as soon as possible. When talking to them it’s also important to make sure you understand the terms of the repayment plan for any missed or altered payments during forbearance. Otherwise, this move could end up having a negative effect on your credit score.

If you don't qualify for a mortgage forbearance or other mortgage relief, consider refinancing your home loan using Credible. See if a mortgage refinance is right for you with your current financial situation.

THIS MORTGAGE RATES MISTAKE COULD COST YOU THOUSANDS

3. Contact your mortgage lender

Lastly, if you're not sure if you'll qualify for low mortgage refinance rates and you don't want to put your loan into forbearance, your first step should be to contact your lender. Many banks and lenders are offering alternative options to forbearance if you are behind on your mortgage. For instance, you could ask for a loan modification, which permanently changes the terms of your loan in order to make it more affordable to you. Alternatively, you could ask to be put on a repayment plan, which can help you catch up to missed payments.

Either way, the first step is to talk to your lender. Visit Credible today to get in touch with an experienced lender who can answer any questions you may have.

HOW REFINANCING YOUR MORTGAGE COULD PUT CASH IN YOUR POCKET

The bottom line

If you can't pay your mortgage during the coronavirus pandemic, there is help available. In the event that you think that simply lowering monthly payments will make a difference, it's a good idea to explore your refinancing options. If you're missing payments or you need more significant help, your best bet is to talk to your loan servicer first. They can review the specifics of your financial situation in order to help you make the best decision for going forward.

You can explore your mortgage refinance options by visiting Credible to compare rates and lenders.

THE BASICS OF NO-CLOSING COST MORTGAGE REFINANCING

"pay" - Google News

January 07, 2021 at 08:18PM

https://ift.tt/2Xg1ESl

Can’t pay your mortgage during coronavirus? Try this now - Fox Business

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "Can’t pay your mortgage during coronavirus? Try this now - Fox Business"

Post a Comment