So your health insurance is going up next year, but you assumed it would, right?

The rates the Office of Personnel Management announced last week for 2021 could be worse, but they could be better.

Financial planners and other experts who follow the Federal Employees Health Benefits Program (FEHBP) told us earlier this fall they predicted health insurance costs for participants would rise significantly this year.

The pandemic is throwing a wrench into everything, and with many insurance carriers waiving costs for COVID-19 testing and other related services, the theory was that someone had to carry the extra burden.

Turns out the pandemic did play a role in setting the upcoming year’s FEHB premiums, but maybe not in the way you might think, according to OPM.

Premium increases for 2021 are based on how federal employees and retirees use the health system in 2020. And with many feds and retirees working from home or hunkered down for a good part of the year, the opportunities to use an expensive health care system were limited — at least for part of 2020.

Many participants may have delayed elective surgeries or other procedures, OPM said, and those delays managed to even things out.

The result? Taking the historical context into perspective, this year’s FEHB premium increases could be worse.

FEHB premiums rise every year, but the increases have really run the gamut since 2015 or so.

In 2016, overall premiums rose 6.4% before leveling off slightly in 2017 and 2018. Employees and retirees themselves paid, on average, 7.4% more for their health insurance in 2016.

But in 2019, FEHB premiums went up just 1.3%. It was the smallest overall rate increase since 1996 and the lowest premium hike for participants since 1995.

The increases were more dramatic in 2020, with overall premiums up 4% and the enrollee share up to 5.6%.

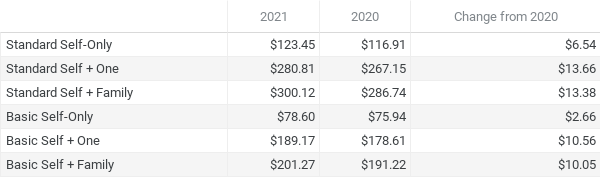

Now for 2021, they’re somewhere in the middle. Take a look at the ever-popular Blue Cross Blue Shield Program. Biweekly premium increases range between 3.5% to 6%.

Employees enrolled in one of these two Blue Cross plans will experience biweekly premium increases ranging from $2.66 to $13.66.

Interestingly enough, participants enrolled in either one of the Blue Cross self-plus-one options will experience higher increases than those enrolled in a self-plus family option.

Per OPM, enrollment in self-plus-one plans has slowly crept up over the years, with 777,695 employees and retirees participating in one of those plans.

About 749,000 people were enrolled in a self-plus-one plan in 2019, up slightly from the 710,000 people enrolled in a plan in 2018, 643,000 in 2017 and 542,000 in 2016.

Now for the “could be better” category.

Health premiums go up annually, but it’s not often that federal employees have their Social Security taxes — roughly 6.2% of their gross biweekly paychecks —deferred until the next year, when they’re expected to pay double.

This, of course, is thanks to the president’s mandatory payroll tax deferral policy, which seems exclusive to federal employees and military members at this point.

While feds are seeing a bump in their paychecks now and through the end of the year, unions and federal organizations are practically begging their members to put aside the extra cash and save it for next year, when about 12% of their pay will go toward Social Security taxes for the first four months of 2021.

Then there’s the prospect of a pay raise for 2021, which, yes, is still up in the air.

If nothing changes between now and the end of the year, and that’s a big “if,” civilian employees are due for a 1% federal pay raise in 2021, per the president’s plan. Congress hasn’t expressed any interest in moving on its own federal pay proposal, at least not now.

If a 1% pay bump goes through, your 2021 health premium hike will almost certainly swallow up that raise.

Federal retirees will feel the impacts of all this too, but in a slightly different way. The Social Security Administration announced a 1.3% cost-of-living adjustment for retirees in 2021, which rising health insurance costs will almost certainly subsume.

The one upside? Retirees aren’t part of the president’s payroll tax deferral.

So what does all this mean? Forecasting your take home pay for 2021 requires a new level of mental gymnastics. Get out those calculators.

Nearly Useless Factoid

By Alazar Moges

The consecutive two term elected presidency’s of Bill Clinton, George W. Bush and Barack Obama has only happened once before in history from 1800 to 1824 when Thomas Jefferson, James Madison and James Monroe were each elected to consecutive terms.

Source: (History, Art & Archives — House of Representatives)

"pay" - Google News

October 17, 2020 at 04:05AM

https://ift.tt/3lUxldX

Calculating your 2021 take-home pay requires some serious mental gymnastics - Federal News Network

"pay" - Google News

https://ift.tt/301s6zB

Bagikan Berita Ini

0 Response to "Calculating your 2021 take-home pay requires some serious mental gymnastics - Federal News Network"

Post a Comment